Thinking Out Loud About Value-for-Value

and the Economics of Bitcoin Culture

This is not a complaint post.

It’s not entitlement.

It’s not a call for pity or donations.

More creators need to: lay out the numbers, the models, and the tradeoffs honestly, so those coming next can make better decisions.

This is that post.

The Value-for-Value Idea

Value-for-value is a clean concept:

Create something valuable. People who find value reciprocate voluntarily.

Bitcoin rails (Lightning, Nostr, Fountain, Geyser) make this easy.

In theory, it’s elegant. In practice, the economics are more complicated.

This isn’t fringe thinking.

It’s a central belief in the V4V movement - especially in Bitcoin circles.

And it’s a powerful idea:

No coercion

No surveillance

No middlemen

No artificial scarcity

The question isn’t whether the idea is good.

The question is whether it currently works at scale for high-effort Bitcoin culture.

Our Experience So Far (MotBC)

Project: Mysteries of the Bitcoin Citadel

Format: Audio drama podcast

Time active: ~1 year

Rough numbers

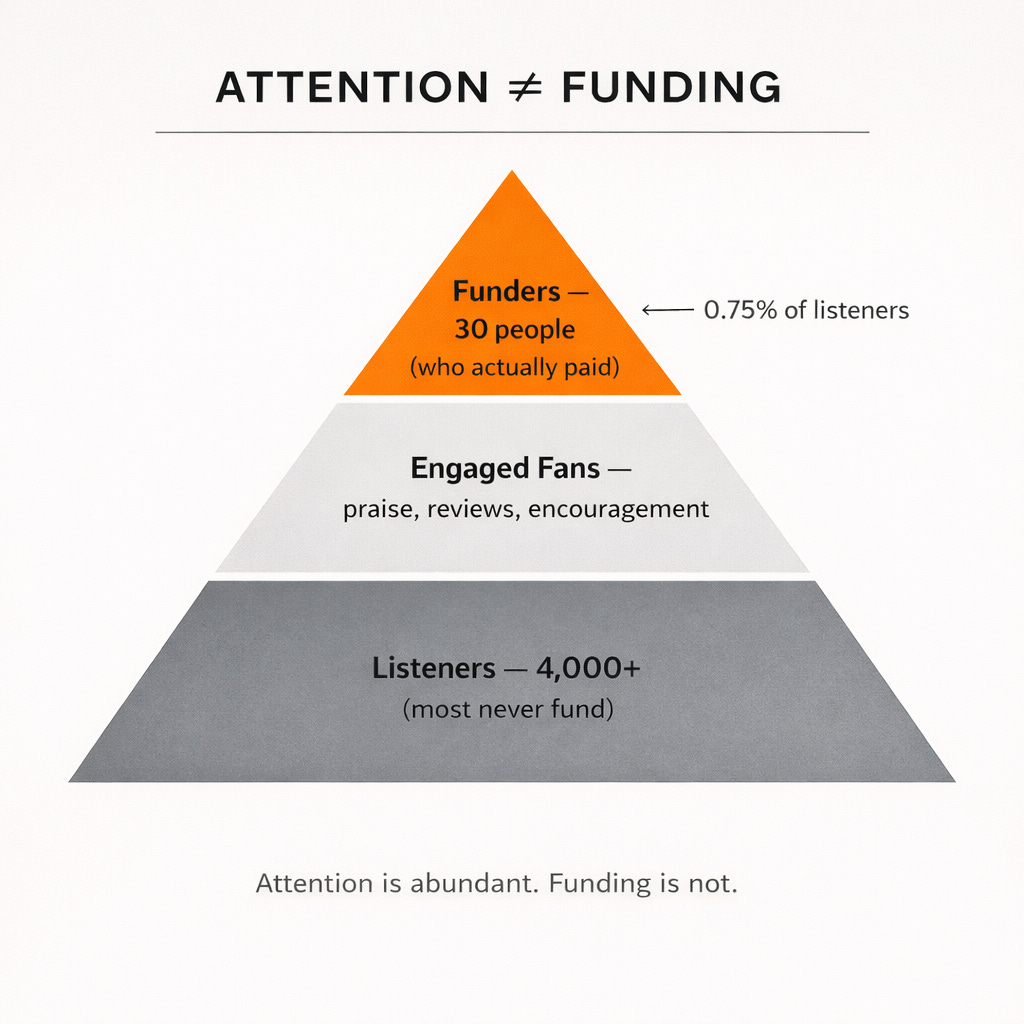

~4,000 total listens

~30 donors (Fountain + Nostr)

~100,000 sats total (~$100 at the time)

≈ 0.025 sats per listen

That’s the raw, unfiltered outcome of value-for-value so far.

What If We Used Ads or Sponsors?

Just to ground expectations, let’s compare against more familiar models.

Platform ads (rough range)

~$0.01–$0.15 per listen (assuming eligibility + scale)

Host-read ads / sponsors

Harder to estimate

Niche audience helps

Could plausibly match ads or maybe 2× ads at best

None of this is guaranteed, but it gives us a sanity check.

Value-for-Value Isn’t the Only Pricing Model

Before we moralize anything, let’s step back.

There are three core ways products get priced, whether people realize it or not.

1. Cost-Plus Pricing

Core Question

What does it cost me to make this?

Formula

Price = Cost + Margin

Inputs Considered

Production costs

Labor

Tools & software

Hosting & distribution

Time spent

Where It Commonly Appears

Manufacturing

Retail

Accounting-driven businesses

“I don’t want to think about pricing” businesses

Why People Use It

Feels fair and rational

Easy to calculate

Internally defensible

Primary Failure Mode

Customers don’t care about your costs

Guarantees underpricing when value is outsized

Tell-Tale Creator Thought

“I’ve spent thousands of hours on this…”

Emotionally true.

Economically irrelevant.

2. Market / Competitive Pricing

Core Question

What does the market expect this to cost?

Formula

Price = Category Norm ± Positioning

Inputs Considered

Competitor pricing

Category averages

Tier expectations

Where It Commonly Appears

SaaS products

Agencies

Apps

Subscription services

Why People Use It

Customers understand it immediately

Signals legitimacy

Reduces pricing friction

Primary Failure Mode

Inherits the market’s bad assumptions

Forces competition on features instead of outcomes

Tell-Tale Creator Thought

“I don’t want to price myself out of the category.”

If the category is underpriced, you will be too.

3. Value-Based Pricing

Core Question

What is this worth to the customer?

Formula

Price = Fraction of Value Delivered

Inputs Considered

Revenue unlocked

Costs saved

Risk avoided

Time reclaimed

Where It Commonly Appears

Consulting

Coaching

High-leverage B2B services

Why People Use It

Decouples price from effort

Rewards leverage over hours

Enables small teams to charge meaningful fees

Primary Failure Mode

Requires deep understanding of customer economics

Customers often don’t know the value themselves

Tell-Tale Creator Thought

“If I make them $100k, charging $10k is obvious.”

This breaks down when value is diffuse, long-term, or cultural - which is why most Bitcoin culture projects cannot use this model directly.

Which brings us back to value-for-value.

Ways Bitcoin Content Gets Funded (Rough Map)

None of these are “pure.” Most projects mix them.

Cost-based

Kickstarter / Geyser (all-or-nothing)

Pre-funding to hit a target margin

Market-based

CPM ads

Sponsor slots priced to category norms

Result-based

Referral links

Performance-based sponsorships

Faith-based

Pure value-for-value

“Field of dreams” economics

Create → hope → repeat

Each has tradeoffs. None are magic.

Reverse-Engineering MotBC (Uncomfortable Math)

Let’s do something most creators avoid.

Assume:

Target: $1,000 per episode

Episodes: 12

Total target: $12,000

Using our current donation rate:

~$100 per 4,000 listens

To hit $12,000:

~480,000 listens total

~40,000 listens per episode

Even if donations scaled linearly (they probably don’t).

So the question becomes:

Is it realistic for a Bitcoin fiction podcast to get that reach?

And if it did… earning $12k total still wouldn’t be life-changing. It wouldn’t even be self-sustaining…

“Maybe We Just Made a Bad Product”

This has to be acknowledged.

That’s always possible.

The only counter-arguments we have:

Strong listener reviews

Direct feedback from people who do find it

The absence of many wildly successful Bitcoin fiction projects (Movies, Books or TV Shows)

Which leads to a broader observation.

The Bitcoin Culture Market Is Still Tiny

Look around.

Ignoring events, the list is short:

A small number of fiction books

What’s a “successful” Bitcoin fiction book?

10,000 copies would be shocking

1,000 copies might put you near the top

Even at $12 per book:

That’s ~$12,000 gross

Before time, taxes, opportunity cost

This isn’t a moral failure.

It’s just the market.

The Uncomfortable Conclusion

Right now:

Bitcoin culture is early

The audience is small

The economics do not yet support full-time creators

Not without extreme outliers or cross-subsidization

Either:

The market must grow dramatically

Or the monetization model must change

Or creators must accept negative or near-zero ROI for years

Measured purely in sats, betting on Bitcoin fiction today is:

a worse gamble than betting on the Maple Leafs to win the Cup.

(And that hurts to say.)

Where That Leaves Us

We’re long Bitcoin culture.

We’re mostly low-time-preference people.

We’ll keep experimenting.

But we’re doing it eyes wide open.

If this becomes self-sustaining, we will be:

Rare

Early

Lucky

Or some combination of all three

And if it doesn’t?

At least the next group will have better numbers than we did.

That, in itself, might still be value.

What do you think?

I think some of the biggest things left to be asked from this article are:

1. Can this existing audience be better mobilized for support?

2. Is there a different audience/niche of Bitcoiners that should be targeted?

3. Do these sort of projects just need to work on their own, and have the Bitcoin angle be a bonus vs the primary focus?

4. How much prompting the audience for support with a V4V model is appropriate? When is it too much begging?