A Simple Bitcoin FIRE Calculator

Keeping It Simple

Prior Bitcoin FIRE Discussions:

Bitcoin Retirement or Bitcoin FIRE

An Oversimplified Approach to Bitcoin FIRE

FIRE E-guide

A Simple Bitcoin FIRE Calculator

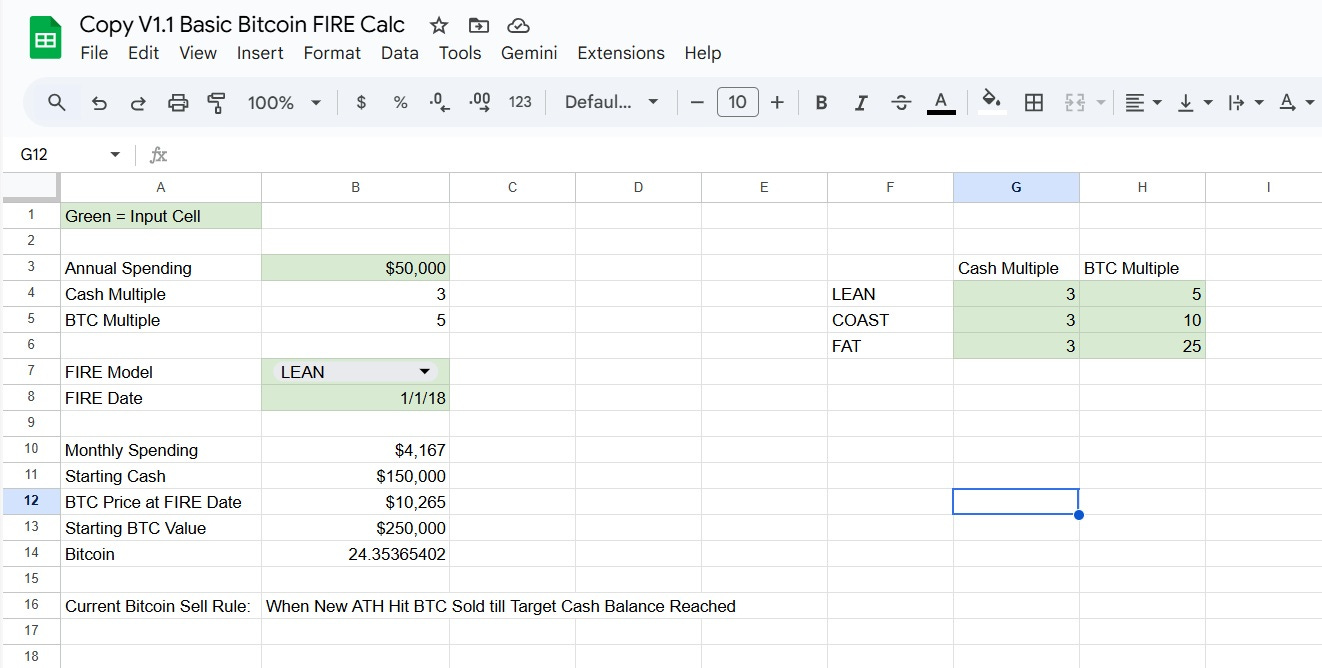

I built a simple calculator to explore Bitcoin-based FIRE.

Not to predict prices.

Not to optimize trades.

Not to tell you when to retire.

It simply explores:

What does financial independence look like if you treat Bitcoin as a long-term reserve instead of a monthly income source?

What the Calculator Is

This is a cash-runway + Bitcoin reserve model, not a traditional withdrawal-rate calculator.

It models three things over time:

Cash: your short-term spending buffer

Bitcoin: a long-term reserve you try not to touch

Time: how long you can wait through volatility without being forced into bad decisions

Instead of asking “Will my portfolio last forever?” it asks:

“How much optionality do I have, and how fragile is my plan?”

How to Use It (at a High Level)

Enter your annual spending

Choose a Bitcoin FIRE model (Lean / Coast / Fat)

Each model has simple assumptions:

Cash multiple (e.g. 3× annual spending)

Bitcoin multiple (e.g. 5×, 10×, 25×)

Pick an exit date

The point where you stop relying on full-time fiat work

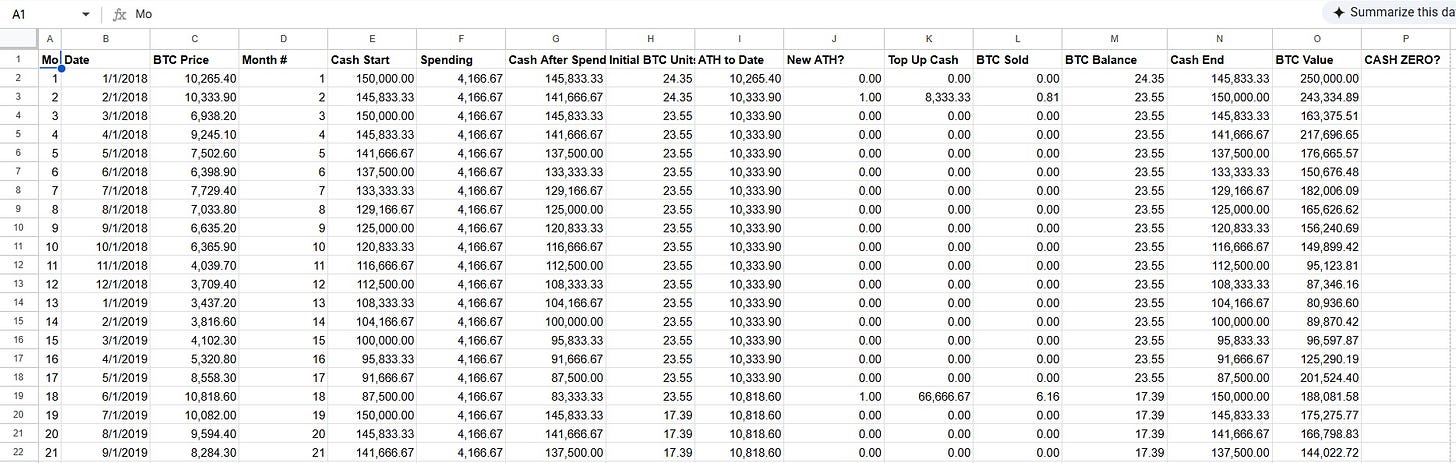

The calculator then:

Walks forward month by month using historical BTC prices

Spends from cash

Tracks Bitcoin without selling unless rules allow it

Shows when cash runs out, refills, or forces adaptation

Note: Currently the calculator rebalances cash whenever a new All Time High is reached.

You can edit all assumptions. Nothing is hard-coded.

What It Shows (and What It Doesn’t)

It shows:

How long a given cash runway actually lasts

What different exit timing looks like historically

How often you’d need to adapt (work, cut spending, wait)

The difference between fragile and resilient plans

It does not show:

Guaranteed outcomes

Optimal selling strategies

A “safe” forever withdrawal rate

Why This Is Valuable

Most FIRE tools assume:

smooth returns

regular withdrawals

low volatility

Bitcoin breaks those assumptions.

This calculator:

respects Bitcoin’s volatility instead of smoothing it away

makes timing risk visible

turns abstract ideas (“I’ll just wait it out”) into something concrete

helps people see the tradeoff between independence vs certainty

Even if you never “retire,” visualizing these paths is useful.

You can see:

when plans get tight

when flexibility matters

where overconfidence creeps in

How I Think About It

Bitcoin doesn’t eliminate work.

It changes the terms of work.

This tool isn’t about escaping responsibility.

It’s about understanding when you have leverage, and when you don’t.

Use it to stress-test assumptions.

Use it to compare paths.

Use it to be more honest with yourself.

For me, simply scrolling through this spreadsheet helps tether the theoretical to the practical.

Version 2

What would you like to see in a Version 2 of this spreadsheet?

If I extend this, the next things I’d explore are:

more flexible cash top-up rules (partial refills, different triggers)

adjustable sell thresholds beyond a simple ATH

inflation-adjusted spending

But even in its current form, the goal is simple:

make tradeoffs visible, without pretending certainty exists.

Did I make a mistake in V1? Please leave a comment with any errors or corrections.